Australian Dollar/U.S. Dollar(AUDUSD)FOREX

Aussie Dollar: A Currency with Roots to its Harvest Season

Currency markets around the world can have seasonal patterns. At the end of fiscal years, tourism, holidays, etc. While these periods can have reliable seasonal impacts on a currency, a more consistent and reliable seasonal pattern is crops and exports.

Australia is a country with a robust commodity base and is often referred to as a "commodity currency." Australia is an essential source of export cereals, meat, sugar, dairy produce, and fruit. However, Australia's main export is iron ore, followed by its other most valuable exports, coal, gold, and petroleum.

Specifications, Descriptions, & Performance

Australia has a floating exchange rate, which means that movements in the Australian dollar exchange rate are determined by the demand for and supply of Australian dollars in the foreign exchange market. Several factors affect demand and supply in this market. Some elements have longer-term effects on the value of the Australian dollar, while others influence its value over shorter periods.

Longer-term Drivers

- Interest rate differentials and capital flows

- Terms of trade and commodity prices

- International trade

- Prices and inflation

Short-term Drivers

- Risk sentiment and speculation

Commodity prices greatly influence the terms of trade (commodities are goods such as iron ore, natural gas, and agricultural products). This is because commodities account for a large share of Australia's exports, so movements in commodity prices result in movements in export prices.

Source: Reserve Bank of Australia (RBA)

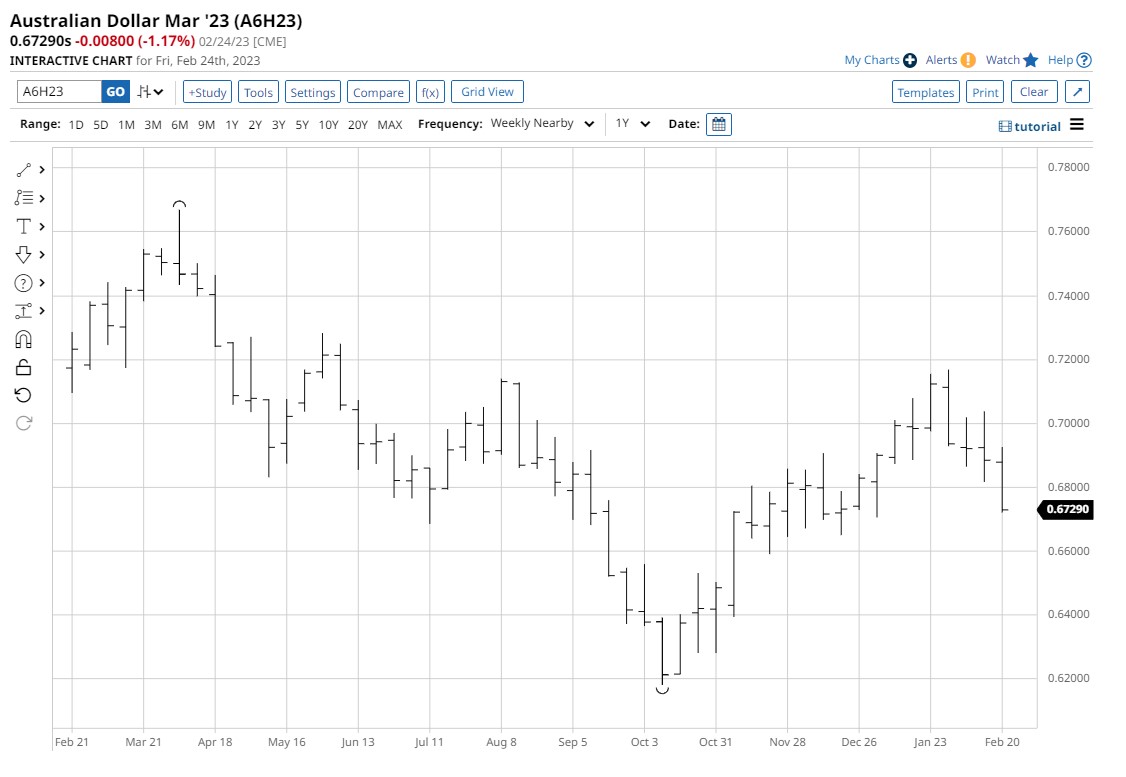

Returns on the Aussie Dollar during the past three months have been flat. The seasonal rally off the October lows had returned 16% before correcting a portion of the rally. Some of this correction can be attributed to the stronger US Dollar due to higher interest rates.

Seasonal

Source: Moore Research Center, Inc. (MRCI)

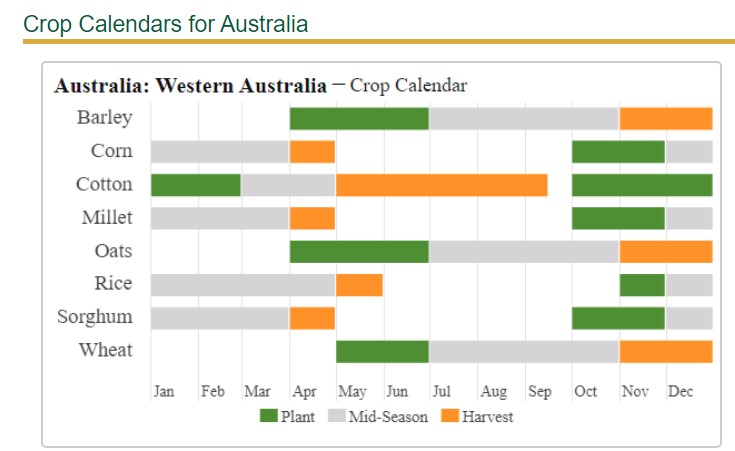

The Aussie Dollar's seasonal low in November-December is relatively consistent due to the upcoming harvest season of the summer crops and the surge in exports to countries such as China and other South Pacific Rim countries. Before the harvest season, countries placing tenders for Australian products must purchase Aussie Dollars before delivery, therefore, tying the Aussie Dollar to a crop cycle and a consistent demand period for Aussie Dollars.

As well as being the nation's largest grain-producing region, Western Australia is a significant producer of Australia's meat and livestock, dairy, wool, horticulture, and honey products. The graph below illustrates the crop season in Western Australia.

Source: United States Department of Agriculture (USDA)

Reviewing the weekly Aussie Dollar chart above, the seasonal low arrived early in mid-October. MRCI has found that markets with early seasonal lows typically result in more decisive price action and longer duration than usual.

The current correction of the February highs is conducive to the Aussie Dollar's typical seasonal pattern. As March approaches, a price base is built, and one more seasonal rally occurs into the mid-April highs. Does this mean it always happens? No, but knowing what a market does typically can better prepare us to analyze opportunities by using confirmations of other tools.

Think of seasonal analysis as a market screener for trading opportunities with an edge in your favor. Your job as a trader is to analyze the market in more depth to determine if the seasonal pattern may perform this season and, if it does, meets your risk parameters.

MRCI historical research has found that the Aussie Dollar peaks in mid-April and declines into their fiscal year-end on June 30. Currency markets have traditionally trended well due to countries' longer-term fiscal views and policies.

Products to Trade the Aussie Dollar

Traders have many different assets available to trade/invest in the Aussie Dollar.

- Standard size Aussie Dollar futures contract (A6) (CMEGroup 6A)

- Micro size Aussie Dollar futures contract (MG) (CMEGroup M6A)

- Forex spot market AUDUSD (Major)

- Options on futures contracts

- Exchange-Traded Fund (ETF) Invesco Australian Dollar Trust (FXA)

Summary

As the southern hemisphere approaches the fall season, the summer crops will be ready for harvest. Countries around the world will require these products to sustain their populations. As the "Commodity Currency," the Aussie Dollar will be in high demand as the world faces a shortfall of commodity inventories.

Traders can find a trade setup to confirm a long Aussie Dollar position based on the upcoming seasonal rally in March or patiently wait for the mid-April seasonal high and see a confirmation that the market is going lower.

Professional traders always have a plan, risk management, adequate capital, experience, and discipline. They will also treat their trading as a business and not a hobby. Professional traders will also understand themselves and how they will react during specific market environments.

In a recent article for Barchart, "Getting Your Trading Edge From Consistently Profitable Traders," I discuss these and other traits needed to succeed in trading.

Ask yourself before trading if you have these characteristics.

More Grain News from Barchart

- 2-4% Losses for Friday Wheat Futures

- Beans Flipped Red for the Week

- Corn Drops into the Weekend

- Cocoa Prices Undercut by Dollar Strength

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.